Tax preparation business name ideas: Choosing the perfect name for your tax business is more than just picking words; it’s about crafting a brand identity that attracts clients and reflects your expertise. Think of it as the first impression – a memorable name can set you apart in a crowded marketplace, while a poorly chosen one could leave you struggling to gain traction. This guide will walk you through the process, from brainstorming creative names to navigating legal considerations and ensuring your chosen name is available across all platforms.

We’ll explore various naming strategies, considering different target audiences and branding approaches. We’ll also delve into the crucial steps of checking for trademark conflicts, securing your domain name, and establishing a consistent brand voice. Get ready to unleash your inner entrepreneur and find the perfect name that will launch your tax preparation business to success!

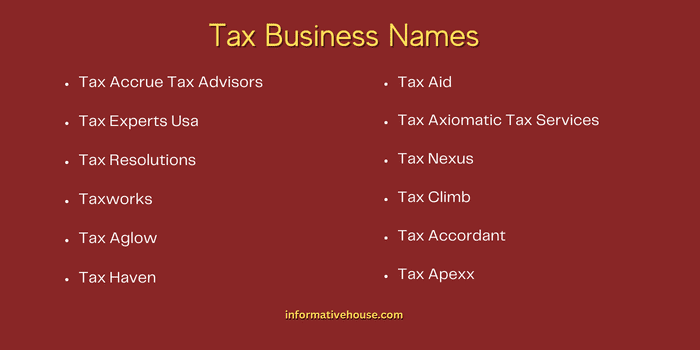

Brainstorming Business Names

Choosing the right name for your tax preparation business is crucial for attracting clients and establishing a strong brand identity. A memorable and relevant name will help you stand out in a competitive market and convey the key qualities that set your services apart. This brainstorming session focuses on generating names that highlight accuracy, speed, personal service, expertise, and geographic relevance.

Business Names Emphasizing Accuracy and Speed

Effective tax preparation requires both meticulous attention to detail and efficient processing. The names below aim to capture this dual focus, suggesting a reliable and quick service. These names utilize strong words associated with precision and swiftness to create a positive impression.

- Precision Tax Pros

- Rapid Return Tax

- Accurate & Swift Taxes

- SpeedTax Solutions

- ExactTax Experts

- On-Time Tax Filing

- QuickTax Masters

- SharpTax Services

- Timely Tax Prep

- Efficient Tax Filing

- Perfect Returns Tax

- Instant Tax Relief

- Zero-Error Tax

- Velocity Tax

- Express Tax Prep

- Agile Tax Solutions

- Precise Tax Planning

- Lightning Fast Taxes

- Streamlined Tax Services

- Rapid Tax Resolution

Business Names Suggesting a Personal and Client-Focused Approach

Building strong client relationships is vital for long-term success in the tax preparation industry. The names below emphasize a personalized approach, conveying care and attention to individual client needs. These names often use softer, more approachable language.

- Your Tax Advocate

- Friendly Tax Solutions

- Personalized Tax Planning

- Client-First Taxes

- The Tax Partner

- Carefree Tax Filing

- Trusted Tax Advisors

- Your Tax Family

- Neighborly Tax Services

- Community Tax Solutions

Business Names Conveying Expertise and Professionalism in Tax Law

Establishing credibility and demonstrating a deep understanding of tax law is essential for attracting high-value clients. These names use terms associated with authority and expertise to project professionalism.

- Tax Law Professionals

- Apex Tax Group

- Strategic Tax Advisors

- Elite Tax Solutions

- Legacy Tax Planning

Business Names Incorporating a Geographic Location

Targeting a specific local market can be highly effective. These names use geographic indicators to appeal to local clients and build a sense of community. This strategy helps establish a strong local presence.

- Downtown Tax Services (City Name)

- [Town/City Name] Tax Professionals

- [County Name] Tax Solutions

- [Neighborhood] Tax Experts

- The [Landmark] Tax Group

Name Availability Check: Tax Preparation Business Name Ideas

Choosing a fantastic name for your tax preparation business is only half the battle. The other, equally crucial, half involves ensuring that name is actually available for use. This involves checking for conflicts across several platforms to avoid legal headaches and ensure a smooth launch. Ignoring this step can lead to costly rebranding down the line.

Trademark Conflicts

Checking for trademark conflicts is a vital step in protecting your business identity. A trademark protects brand names and logos, preventing others from using similar names that could cause confusion in the marketplace. The process involves searching the United States Patent and Trademark Office (USPTO) database. You can conduct a search using s related to your proposed business name. The USPTO website offers a search interface that allows you to filter results by various criteria, such as goods and services. Thoroughly review the results to identify any existing trademarks that are similar to your proposed name. Consider consulting with a legal professional if you find any potentially conflicting trademarks to assess the risk and explore your options. Remember, even similar-sounding names could create confusion and lead to legal action. For example, if your chosen name is “Tax Solutions Plus,” a pre-existing “Tax Solutions Pro” might cause conflict.

Domain Name Availability

Securing a relevant domain name (like yourbusinessname.com) is essential for establishing an online presence. Several domain registrars (like GoDaddy, Namecheap, Google Domains) allow you to check for domain name availability. Simply enter your desired name into the search bar on their website. If the domain is available, you can proceed with registration. If not, you might need to brainstorm alternative names or add variations (e.g., adding your location or a descriptive term). Consider registering various extensions (.com, .net, .org) to protect your brand and prevent others from using similar domains. For example, if “TaxWiz.com” is unavailable, you could try “TaxWizSolutions.com” or “TaxWiz.net”.

Social Media Handle Availability

Your business needs a consistent brand identity across social media platforms. Check the availability of your desired name on major platforms like Facebook, Instagram, X (formerly Twitter), and LinkedIn. Each platform has its own search functionality to check usernames or page names. It’s crucial to secure your chosen name on these platforms to maintain a unified brand identity and avoid confusion among potential clients. If your preferred handle is unavailable, you may need to modify it slightly or use a combination of words. For example, if “@TaxPros” is taken on Instagram, you could try “@TaxProsInc” or “@TaxProsSolutions”.

Name Availability Verification Checklist, Tax preparation business name ideas

Before launching your tax preparation business, ensure you complete the following steps:

- Conduct a thorough trademark search on the USPTO website.

- Check domain name availability with multiple domain registrars.

- Verify social media handle availability on major platforms.

- Review search results carefully for any potential conflicts.

- Consult with a legal professional if necessary.

Branding and Target Audience

Choosing the right name for your tax preparation business is crucial; it’s the first impression you make on potential clients and significantly impacts your brand perception. A well-chosen name will resonate with your target audience, communicate your value proposition, and set you apart from competitors. This involves careful consideration of your ideal client and the message you want to convey.

Effectively branding your tax preparation business requires understanding your diverse potential clientele and tailoring your approach accordingly. Different groups have varying needs and expectations, influencing their choice of tax preparer. Therefore, a multifaceted branding strategy is key to success.

Target Audience Segmentation and Business Names

Identifying distinct target audiences allows for focused marketing and a more impactful brand message. Here are three examples:

- Target Audience 1: Busy Professionals and Entrepreneurs. These individuals value speed, efficiency, and expertise. They are willing to pay a premium for convenience and accurate, reliable service. A suitable business name might be “Apex Tax Solutions”, implying high-level service and achievement. The branding would emphasize professionalism, speed, and accuracy, perhaps utilizing a sophisticated logo and color palette.

- Target Audience 2: Families and Individuals with Moderate Incomes. This group prioritizes affordability and clear, straightforward communication. They need a trustworthy preparer who can help them maximize their refunds while keeping things simple. A suitable name could be “Family Tax Advisors” or “SmartTax Solutions”, conveying approachability and value. The branding should be friendly and relatable, using warm colors and simple, clear messaging.

- Target Audience 3: Small Business Owners. This group requires specialized knowledge of business tax regulations and needs a preparer who understands their unique financial situations. A fitting name could be “Business Tax Pros” or “Strategic Tax Planning”, highlighting expertise and strategic thinking. The branding should convey competence, professionalism, and a deep understanding of business finances. A more formal logo and website design would be appropriate.

Branding Implications of Affordability versus Premium Service

The choice between emphasizing affordability or premium service significantly impacts your branding. A name that suggests affordability, such as “Budget Tax,” might attract price-sensitive clients but could deter those seeking high-end service. Conversely, a name like “Executive Tax Services” might attract high-net-worth individuals but could alienate those on a tighter budget. The branding must consistently reflect this chosen positioning; using low-cost marketing materials for a premium service would be counterproductive.

Impact of Straightforward versus Creative Names

A straightforward name like “ABC Tax Services” clearly communicates your services but lacks memorability and personality. A creative name, like “Tax Titans” or “Number Ninjas,” is more memorable and potentially more engaging, but it might not immediately communicate your services. The choice depends on your branding strategy. A straightforward name is suitable for a business focused on reliability and trust, while a creative name is better for a business aiming for a unique brand identity and attracting attention in a competitive market. The key is consistency; the name should align with your overall branding and marketing efforts.

Cultural Sensitivity in Choosing a Business Name

Cultural sensitivity is paramount. A name that is offensive or insensitive to a particular cultural group can severely damage your reputation and alienate potential clients. Thorough research and careful consideration of connotations in different languages and cultures are crucial. Before finalizing a name, consider seeking feedback from diverse individuals to ensure it is appropriate and inclusive. For example, a name that sounds similar to a negative term in another language should be avoided, even if it sounds positive in your primary language.

Legal and Regulatory Considerations

Navigating the legal landscape is crucial for any tax preparation business. A seemingly innocuous name choice can lead to significant problems down the line, impacting your credibility and potentially exposing you to legal action. Understanding the regulations and potential pitfalls is essential for a successful and compliant operation. This section will explore potential legal issues and the implications of different business structures on your name selection.

Choosing the right business name is a balancing act between creativity and compliance. A memorable name is essential for attracting clients, but it must also adhere to legal standards to avoid costly repercussions. Ignoring these considerations can result in fines, lawsuits, and even business closure.

Misleading Business Names and Regulatory Violations

Certain business names can be misleading or violate regulations. For example, a name like “IRS Certified Tax Experts” would be misleading if the business owners lack the appropriate IRS certifications. Similarly, using a name that suggests a connection to a government agency, without official authorization, is a serious legal transgression. A name implying affiliation with a specific accounting firm, without permission, could also result in legal action. Names that are overly similar to established businesses in the same field could infringe on trademarks. Finally, names that contain profanity or are otherwise offensive are likely to violate local business registration rules.

Potential Legal Issues Related to Business Names

Several legal issues can arise from improper business name selection in the tax preparation industry. These include:

- Trademark Infringement: Using a name too similar to an existing trademark can lead to legal action from the trademark holder.

- Copyright Infringement: Using a name or logo that infringes on existing copyrighted material.

- Misrepresentation/Consumer Deception: Using a name that misleads clients about your qualifications or services.

- Violation of State and Federal Regulations: Failing to comply with state and federal regulations regarding business registration and naming conventions.

- Unfair Competition: Engaging in practices that unfairly compete with other businesses, such as using a confusingly similar name.

Legal Implications of Different Business Structures on Name Selection

The choice of business structure significantly impacts name selection. Here’s a comparison:

| Business Structure | Name Requirements | Liability | Name Restrictions |

|---|---|---|---|

| Sole Proprietorship | Often uses owner’s name or a DBA (Doing Business As) name, requiring registration with the state. | Unlimited personal liability | Limited restrictions, but must comply with state naming laws; DBA registration may be needed. |

| LLC (Limited Liability Company) | More flexibility; can use a name not directly related to the owner, but must include LLC or similar designation. | Limited liability, protecting personal assets | Must comply with state naming laws and often include “LLC,” “L.L.C.,” or similar designation. Name cannot be misleading or suggest a connection to a government entity. |

| Partnership | Often uses the names of partners or a chosen business name, requiring registration with the state. | Partners share liability | Similar to sole proprietorships and LLCs, requiring compliance with state naming laws and avoiding misleading or unauthorized names. |

| S Corporation | Similar to LLCs, offering flexibility but requiring compliance with state and federal regulations. | Limited liability, but complex tax regulations | Must comply with state naming laws and often include a designation indicating corporate status. Name cannot be misleading. |

Visual Representation and Logo Design

Choosing the right visual identity is crucial for a tax preparation business. A well-designed logo communicates professionalism, trustworthiness, and expertise – qualities vital for attracting and retaining clients. The visual elements should reflect the brand personality and resonate with the target audience, creating a lasting impression.

Logo design is more than just a pretty picture; it’s a strategic investment that builds brand recognition and reinforces your company’s values. A memorable logo helps clients easily identify your services amidst the competition, leading to increased brand recall and ultimately, more business. Consider the logo as the face of your company – it should be both visually appealing and strategically effective.

Logo Design Styles

Three distinct logo styles can effectively represent a tax preparation business. Each offers a unique approach to conveying professionalism and trustworthiness.

- Classic and Elegant: This style typically features a sophisticated typeface, often serif, combined with subtle imagery like a stylized balance scale or a simple geometric shape representing stability and accuracy. The color palette is usually muted and refined, using colors like navy blue, deep green, or charcoal gray to convey authority and reliability. This style projects an image of experience and dependability, appealing to a more established and conservative clientele.

- Modern and Minimalist: This approach prioritizes simplicity and clean lines. The logo might incorporate a single, strong icon, perhaps a stylized dollar sign or a graph representing growth, paired with a modern sans-serif font. The color scheme often utilizes a single bold color or a high-contrast combination of two colors to create a memorable and impactful visual. This style attracts clients who appreciate efficiency and straightforwardness.

- Friendly and Approachable: This style uses softer imagery and a warmer color palette to create a welcoming and less intimidating brand image. The logo might feature a friendly icon, such as a stylized leaf or a friendly character representing financial growth, paired with a rounded, easy-to-read font. Colors such as light greens, oranges, or blues can be incorporated to convey a sense of optimism and approachability. This style is particularly effective for attracting younger clients or those who might find traditional tax preparation services daunting.

Color Palettes

The psychological impact of color is significant in branding. Careful color selection can evoke specific emotions and associations, influencing how clients perceive your business.

- Deep Blue and Gold: Evokes feelings of trust, stability, and wealth. Blue represents security and professionalism, while gold suggests luxury and success. This combination is classic and authoritative.

- Emerald Green and Cream: Projects an image of growth, prosperity, and calmness. Green symbolizes nature, renewal, and financial growth, while cream adds a touch of sophistication and elegance. This palette is both reassuring and sophisticated.

- Navy Blue and Silver: Communicates competence, precision, and technology. Navy blue conveys authority and trustworthiness, while silver adds a modern and sleek touch, suggesting efficiency and accuracy. This is a good choice for a tech-savvy tax preparation business.

- Forest Green and Beige: Conveys stability, reliability, and earthiness. Forest green evokes a sense of security and growth, while beige adds a touch of warmth and approachability. This combination is calming and reassuring.

- Dark Gray and Teal: Represents sophistication, innovation, and balance. Dark gray projects professionalism and stability, while teal adds a touch of modernity and creativity. This is a contemporary and sophisticated option.

Logo Description

One possible logo design could feature a stylized upward-trending graph incorporated within a simplified representation of a tax form. The graph, rendered in a vibrant green, would visually represent financial growth and success. The tagline, “Growing Your Future, One Return at a Time,” would be positioned below the visual element, reinforcing the message of financial prosperity and personalized service. The overall design would utilize a modern, minimalist style with a clean sans-serif font and a color palette of green and a neutral gray, creating a professional yet approachable image.

Marketing and Communication

A compelling business name is the cornerstone of a successful tax preparation business marketing strategy. It’s the first impression you make on potential clients, influencing their perception of your expertise, professionalism, and overall brand. A well-chosen name can significantly impact your marketing efforts, streamlining communication and boosting brand recognition. Conversely, a poorly chosen name can hinder your marketing reach and create confusion in the marketplace.

A strong business name acts as a powerful marketing tool, simplifying your branding and communication strategies across various platforms. It allows for consistent messaging, enhancing customer recall and trust. This section explores how a business name influences marketing, the importance of consistent brand messaging, and the role of memorability in building a successful tax preparation brand.

Business Name Impact on Marketing Efforts

The right name can significantly reduce marketing costs and increase effectiveness. For example, a name like “TaxEase Solutions” immediately communicates the service offered and implies simplicity and efficiency. This clarity reduces the need for extensive explanations in marketing materials. In contrast, a name like “AlphaNumeric Fiscal Consulting” might sound impressive but requires more effort to explain its relevance to the average client. This difference translates to marketing materials needing more space and potentially higher advertising costs to clarify the service provided. Furthermore, a memorable name, such as “TaxEase Solutions,” is easier to share through word-of-mouth marketing, generating organic leads at minimal cost. A more complex name requires more effort to recall and share, hindering this vital organic growth strategy.

Creating a Consistent Brand Voice and Message

Maintaining a consistent brand voice and message across all marketing channels is paramount. Your business name should directly inform this voice. If your name is “TaxSmart Pros,” your marketing materials should reflect a knowledgeable, helpful, and professional tone. Using a playful, informal tone would contradict the image projected by the name, potentially confusing your target audience. Consistency is key. Your website, social media posts, brochures, and even email signatures should all project the same personality and message. For instance, if your brand voice is professional and trustworthy, ensure all communication reflects this, from the language used to the visual elements employed. Inconsistency can lead to a diluted brand identity and damage customer trust.

Memorable Business Name and Customer Recall

A memorable business name significantly improves customer recall and brand recognition. Consider the impact of a catchy, easily pronounceable name like “TaxTime Titans” versus a more generic name like “ABC Tax Services.” The former is more likely to stick in a client’s memory, leading to increased referrals and repeat business. Memorable names often incorporate alliteration, rhyming, or unique word combinations that make them stand out. Furthermore, a memorable name simplifies the process of building brand recognition, particularly in a competitive market. Clients are more likely to remember and recommend a business with a memorable name, fostering positive word-of-mouth marketing and reducing reliance on expensive advertising campaigns. This translates to a cost-effective approach to brand building and customer loyalty.

Common Queries

What if my ideal name is already taken?

Don’t panic! Brainstorm variations, add a location-specific element, or try incorporating s related to your services. Consider using a name generator tool for fresh ideas.

How important is a catchy name?

A memorable name is crucial for brand recognition and customer recall. However, it shouldn’t come at the cost of clarity or relevance to your services. Aim for a balance of memorability and descriptive power.

Should I use my own name in the business name?

Using your name can build trust and credibility, but consider if it limits your future growth or branding flexibility. A more abstract name offers broader appeal and scalability.

What are the costs associated with registering a business name?

Costs vary by location and business structure. Check with your local government or relevant authorities for specific fees associated with registering your business name and obtaining any necessary licenses.