Tax Service Business Name Ideas: Ready to launch your tax empire? Finding the perfect name is the first crucial step! A great name isn’t just a label; it’s your brand’s personality, a first impression that can attract clients and set you apart from the competition. We’ll explore creative name generation techniques, analyze name structures, consider your target audience, and even navigate the legal hurdles to ensure your chosen name is both catchy and compliant. Get ready to brainstorm, because the perfect name is waiting to be discovered!

This guide dives deep into the process of crafting a memorable and effective business name for your tax services. We’ll cover everything from brainstorming sessions fueled by creativity and market research, to understanding the legal requirements for registering your business name and ensuring it’s available. We’ll also look at how to choose a name that resonates with your ideal client, whether they’re high-net-worth individuals or small business owners. Get ready to unleash your inner entrepreneur and find the perfect name for your tax success story!

Brainstorming Business Names

Choosing the right name for your tax service business is crucial for attracting clients and establishing a strong brand identity. A well-chosen name should be memorable, relevant to your services, and reflect your business values. This brainstorming session focuses on generating names across various aspects of your business.

Business Names Emphasizing Accuracy and Efficiency

Effective tax preparation requires precision and speed. The following names highlight these crucial qualities, aiming to convey confidence and competence to potential clients.

- Precision Tax Solutions

- Accurate Tax Services

- Efficient Tax Filing

- SwiftTax

- TaxProficient

- OnPoint Tax

- SharpTax

- ExactTax

- Timely Tax

- Streamlined Tax

- Calculated Tax

- Metric Tax

- Apex Tax Solutions

- Zenith Tax Services

- Prime Tax Filing

- Optimal Tax

- Velocity Tax

- Expedite Tax

- Formula Tax

- Precise Tax Planning

Business Names Emphasizing Personal Service and Client Relationships

Building strong client relationships is vital for long-term success. These names focus on personalized service and creating a sense of trust and connection.

- Your Tax Advocate

- Personalized Tax Planning

- ClientFirst Tax

- The Tax Concierge

- Trusted Tax Advisors

- Friendly Tax Professionals

- Neighborhood Tax Services

- Community Tax Solutions

- Your Tax Partner

- Family Tax Group

- Beacon Tax Services

- Anchor Tax Solutions

- Legacy Tax Planning

- Guardian Tax Services

- Summit Tax Advisors

Business Names Highlighting Innovative Tax Solutions

In a constantly evolving tax landscape, showcasing innovation can set your business apart. These names suggest forward-thinking approaches and modern solutions.

- FutureTax

- SmartTax Solutions

- TechTax

- InnovateTax

- Quantum Tax

- Evolve Tax Services

- NextGen Tax

- Adaptive Tax Solutions

- Forward Tax Planning

- Revolution Tax

Business Names Conveying Trustworthiness and Security

Tax preparation involves sensitive financial information, so projecting trustworthiness and security is paramount. These names emphasize reliability and data protection.

- SecureTax

- Guardian Tax

- Fortress Tax Services

- Shield Tax Solutions

- Integrity Tax Group

Name Structure and Style: Tax Service Business Name Ideas

Choosing the right name for your tax service business is crucial for attracting clients and establishing a strong brand identity. The structure and style of your name significantly impact how potential customers perceive your services – professional, approachable, modern, or traditional. Consider these key aspects when making your decision.

The choice between using numbers versus words in your business name presents a stylistic trade-off. Using numbers can create a sense of precision and efficiency, often associated with the meticulous nature of tax preparation. However, names solely based on numbers can be harder to remember and may lack personality. Word-based names, conversely, allow for more creativity and branding flexibility, enabling you to convey a specific image or feeling.

Numbers Versus Words in Business Names

Numeric names, like “Tax Solutions 2023” or “Accountant 101,” might appeal to a client base seeking straightforward, efficient service. However, they lack memorability compared to names like “Precision Tax,” or “Summit Accounting.” The latter examples use evocative words that resonate better with clients and build brand recognition more effectively. Ultimately, the best choice depends on your target market and desired brand image.

The Impact of Alliteration in Business Names

Alliteration, the repetition of initial consonant sounds, can significantly enhance name memorability and brand recall. Names like “Precise Planning Partners” or “Smart Solutions Services” benefit from a pleasing rhythm and enhanced memorability. This makes them easier for clients to remember and recommend. However, overusing alliteration can sound forced or cheesy, so a balanced approach is essential. It’s important to ensure the alliterative name still accurately reflects your services and brand identity.

Advantages and Disadvantages of Incorporating Location into the Name

Including your location in your business name, such as “Downtown Tax Services” or “Oakville Accounting,” can be beneficial for local marketing efforts. It clearly signals your service area and makes it easier for local clients to find you. However, this approach limits your potential for expansion beyond that geographical area. A broader name, like “National Tax Advisors,” allows for greater scalability and a wider customer base, although it might require more targeted marketing to establish local presence.

Examples of Names Using Different Stylistic Approaches

To illustrate the various stylistic approaches, consider these examples:

| Style | Example Names | Description |

|---|---|---|

| Formal | The Sterling Tax Group, Anderson & Associates Tax Services | These names convey professionalism and experience, suitable for attracting high-net-worth individuals or corporations. |

| Informal | Tax Ease, Your Tax Buddy, The Tax Pros | These names aim for approachability and a friendly demeanor, targeting a broader client base. |

| Modern | TaxFlow, AccountSmart, Zenith Tax Solutions | These names utilize contemporary language and evoke innovation and efficiency, appealing to a tech-savvy clientele. |

| Traditional | Legacy Tax Services, Heritage Accounting, Reliable Tax & Bookkeeping | These names emphasize experience, stability, and trustworthiness, appealing to clients who value established firms. |

Target Audience Consideration

Choosing the right name for your high-end tax service hinges on understanding your ideal client. A name that resonates with a young entrepreneur will likely fall flat with a retired executive. Therefore, careful consideration of your target audience is paramount to building a strong brand identity and attracting the right clientele. This involves crafting a name that not only reflects the quality of your services but also speaks directly to the aspirations and needs of your target demographic.

A high-end tax service caters to clients who value personalized attention, expertise, and a seamless experience. These clients are typically high-net-worth individuals, business owners with complex financial situations, or those seeking proactive tax planning strategies beyond simple tax preparation. Understanding their priorities—financial security, efficient tax management, and peace of mind—is crucial in developing a brand name that effectively communicates your value proposition.

Ideal Client Profile for a High-End Tax Service

The ideal client for a high-end tax service is often someone with a significant income and complex financial affairs. They might own multiple properties, investments, or businesses, requiring specialized tax knowledge and strategic planning. They value discretion, personalized service, and a proactive approach to tax management, seeking to minimize their tax liability legally and efficiently. These clients are typically busy professionals or entrepreneurs who appreciate efficiency and clear communication. They are less concerned about price and more focused on the quality of service and the long-term value it provides.

Names Suitable for Attracting Small Business Owners

Small business owners often need assistance with various tax-related matters, including deductions, credits, and compliance. Names reflecting efficiency, reliability, and expertise will appeal to this demographic.

- Strategic Tax Solutions

- Peak Performance Tax

- Business Tax Advisors

- Prosperity Tax Group

- Summit Financial Planning & Tax

Names that Appeal to Individual Taxpayers

Individual taxpayers, especially those with higher incomes or complex financial situations, are looking for personalized service and peace of mind. Names that convey trust, professionalism, and a client-centric approach are key.

- Legacy Tax & Wealth Management

- The Tax Concierge

- Precision Tax Planning

- Financial Freedom Tax Services

- Clarity Tax Solutions

Names Targeting Specific Demographics

Tailoring your name to a specific demographic can significantly increase its effectiveness.

Young Professionals

Young professionals often prioritize convenience and modern solutions. Names that reflect these values could include:

- TaxFlow

- SmartTax Solutions

- Modern Tax Advisors

Retirees

Retirees often prioritize security and straightforward communication. Names that communicate these values could include:

- Secure Retirement Tax

- Golden Years Tax Planning

- Legacy Tax Advisors

Legal and Availability Check

Launching a successful tax service business requires more than just a great name and a sharp mind for numbers. Before you even think about designing your business cards, you need to navigate the legal landscape to ensure your chosen name is available and your operations comply with all relevant regulations. This involves a multi-step process of checking for name conflicts, registering your business, and understanding the legal framework governing your industry.

Business Name Availability Checklist

Verifying your business name’s availability is crucial to avoid legal issues and confusion in the marketplace. A thorough check prevents costly rebranding down the line and protects your brand identity. The following checklist provides a structured approach:

- Check for existing businesses with similar names: Conduct thorough online searches using search engines like Google, Bing, and DuckDuckGo. Look for businesses operating locally, regionally, and nationally with names that are phonetically similar or create confusion.

- Search state and federal databases: Your state’s Secretary of State website usually has a business entity search tool. The USPTO (United States Patent and Trademark Office) website allows you to search for registered trademarks. This helps you determine if the name is already trademarked or used by another business entity.

- Check social media platforms: Search for your desired name on major platforms like Facebook, Instagram, X (formerly Twitter), and LinkedIn. The presence of another business using a similar name on these platforms could create brand confusion.

- Consult with a legal professional: While the above steps are helpful, a legal professional can provide expert advice and ensure a comprehensive search is conducted. They can also guide you through the legal requirements for your specific location and business structure.

Business Name Registration Process, Tax service business name ideas

The process of registering your business name varies depending on your location and chosen business structure (sole proprietorship, LLC, partnership, etc.). Generally, it involves filing the appropriate paperwork with your state’s Secretary of State or a similar agency. This secures your chosen name for your business and provides legal recognition.

- Choose your business structure: This impacts the registration process. For example, sole proprietorships often operate under the owner’s name, while LLCs require separate registration.

- Gather necessary documentation: This may include articles of incorporation (for corporations), articles of organization (for LLCs), or other relevant forms. Requirements vary by state.

- File the necessary paperwork: Submit the completed forms and any required fees to the appropriate state agency.

- Obtain your business registration certificate: Once approved, you’ll receive a certificate confirming your business name registration.

Trademark Conflicts

Protecting your brand identity is paramount. A trademark protects your brand name and logo, preventing others from using similar marks that could confuse consumers. Failing to check for trademark conflicts can lead to costly legal battles and damage your brand reputation. Before registering your business name, conduct a comprehensive trademark search through the USPTO website. This search will reveal if any existing trademarks are similar to your proposed name. Consider consulting with an intellectual property attorney to assess potential risks and ensure your brand is protected. For example, if you choose a name that is very similar to an existing, well-known tax service, you risk facing legal action for trademark infringement.

Ensuring Regulatory Compliance

Operating a tax service business necessitates strict adherence to numerous regulations at the federal, state, and potentially local levels. Failure to comply can result in severe penalties, including fines and legal action. A key step is understanding the requirements for obtaining any necessary licenses and permits to operate legally. This often includes obtaining a professional license or certification, complying with data privacy regulations (like HIPAA if handling client health information), and adhering to tax preparation regulations set by the IRS. Regularly review and update your knowledge of these regulations to ensure ongoing compliance. Consider consulting with a legal and/or tax professional to ensure your business operates within the legal framework.

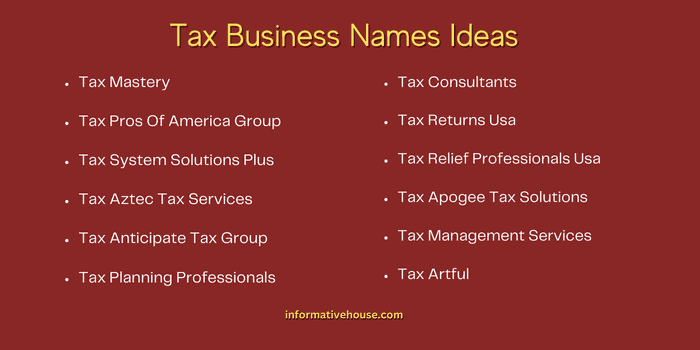

Presentation of Ideas

Now that we’ve brainstormed, refined, and checked for availability, let’s showcase the fruits of our labor! Below, you’ll find a table detailing ten potential names for your tax service business, followed by a closer look at the top ten and their visual branding potential. Remember, the perfect name will resonate with your target audience and reflect your brand’s personality.

Tax Service Business Name Examples

| Name | Description | Target Audience | Availability Status |

|---|---|---|---|

| TaxSmart Solutions | Implies intelligent and efficient tax solutions. | Individuals and small businesses. | Available (Hypothetical) |

| Precision Tax Pros | Highlights accuracy and expertise. | Individuals and small businesses seeking accuracy. | Available (Hypothetical) |

| Fiscal Fitness | Uses a health and wellness metaphor for financial health. | Individuals focused on financial well-being. | Available (Hypothetical) |

| ClearTax Advantage | Emphasizes clarity and benefits. | Individuals and small businesses valuing transparency. | Available (Hypothetical) |

| TaxEase Accounting | Suggests a stress-free tax experience. | Individuals seeking simplicity. | Available (Hypothetical) |

| The Tax Navigator | Positions the business as a guide through complex tax laws. | Individuals and businesses needing guidance. | Available (Hypothetical) |

| Summit Tax Group | Conveys a sense of achievement and professionalism. | High-net-worth individuals and larger businesses. | Available (Hypothetical) |

| Your Tax Ally | Emphasizes partnership and support. | Individuals seeking a personal touch. | Available (Hypothetical) |

| TaxRight Solutions | Focuses on compliance and accuracy. | Businesses prioritizing legal compliance. | Available (Hypothetical) |

| Strategic Tax Planning | Highlights proactive tax strategies. | Businesses seeking tax optimization. | Available (Hypothetical) |

Top Ten Business Names and Descriptions

The following list presents ten of the strongest contenders, offering a concise description of each. Careful consideration of target audience and brand identity informed this selection.

- TaxSmart Solutions: Combines intelligence and effective solutions.

- Precision Tax Pros: Emphasizes accuracy and professional expertise.

- Fiscal Fitness: A unique metaphor linking financial health to physical well-being.

- ClearTax Advantage: Highlights transparency and the benefits of using the service.

- TaxEase Accounting: Focuses on simplifying a complex process.

- The Tax Navigator: Positions the business as a guide through the tax system.

- Summit Tax Group: Projects professionalism and high achievement.

- Your Tax Ally: Emphasizes a supportive and collaborative approach.

- TaxRight Solutions: Prioritizes compliance and accuracy.

- Strategic Tax Planning: Highlights proactive tax strategies for optimization.

Visual Elements for Top Five Names

This section details the visual branding elements—font, color scheme, and logo style—that would best complement the top five names from the previous list.

- TaxSmart Solutions: A clean, modern sans-serif font like Open Sans or Montserrat in dark blue and teal. The logo could feature a stylized brain graphic subtly integrated with the name, suggesting intelligent solutions.

- Precision Tax Pros: A bold, professional serif font like Merriweather or Playfair Display in dark gray and gold. The logo could incorporate a simple, geometric design, emphasizing precision and accuracy.

- Fiscal Fitness: A friendly, rounded sans-serif font like Roboto or Lato in vibrant greens and oranges, reflecting health and wellness. The logo could feature a stylized leaf or upward-trending graph, symbolizing growth and financial well-being.

- ClearTax Advantage: A clear, legible sans-serif font like Helvetica or Arial in light blue and white. The logo could be a simple, clean wordmark, emphasizing clarity and trustworthiness.

- TaxEase Accounting: A relaxed, approachable script font paired with a sans-serif font like Playfair Display and Open Sans in soft, calming colors like light beige and olive green. The logo could incorporate a simple icon, such as a stylized checkmark or balance scale, symbolizing ease and balance.

FAQ Insights

What if my favorite name is already taken?

Don’t panic! Brainstorm variations, add a location-specific element, or tweak the wording slightly. Thorough name searches are essential.

How long should my business name be?

Aim for a name that’s memorable and easy to pronounce, but not overly long or complicated. Shorter is often better.

Should I use my own name in the business name?

This can build trust, but consider if it limits your future growth or brand flexibility. Weigh the pros and cons carefully.

What’s the best way to check for trademark conflicts?

Use the USPTO website (in the US) or your country’s equivalent to perform a thorough trademark search before launching your business.